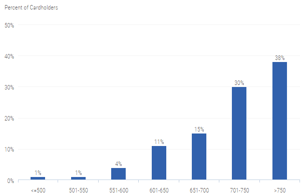

35+ Mortgage rates by credit score 2021

620 Highest mortgage rates. The lower the score the higher the interest rate and the harder it may be to find a lender.

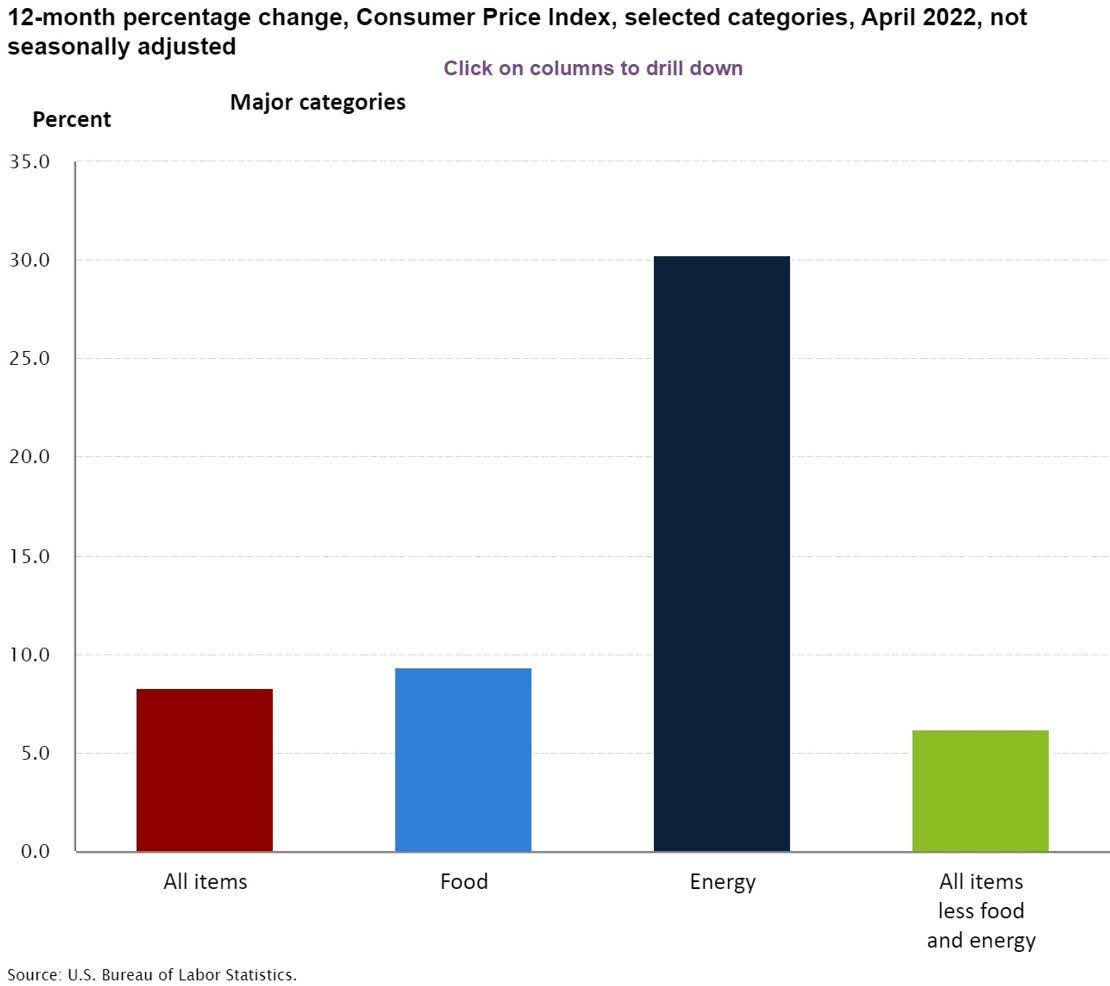

Why Are Mortgage Rates Falling After The Fed Raised Interest Rates

Ad Change Happens Fast.

. That trend continued in the early weeks of 2021 but ended with a rise in mortgage rates toward the end of January. That increased from 299 to 299. Take Advantage And Lock In A Great Rate.

Fannie and Freddie Mac generally dont lend to borrowers with scores below 620. Todays rate is currently lower than the 52-week high of 343. If your score is lower.

Todays Mortgage Rates Trends - August 31 2022. The latest rate on a 101 ARM is 3404. Compare up to 5 free offers now.

Ad Pre Approval Home Loan Easy Process 100 Online Fast Approval Best Rates for 2022. Navy Federal Credit Union offers FreedomLock a rate -lock program that allows you. Protect Yourself From a Rise in Rates.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Nows the Time to Check In On Your Credit with TransUnion. One step further the lower middle score between applicants will be used.

Borrower B has a 580 FICO and is getting quoted a mortgage rate of 55 with 2 discount points. Lock Your Rate Now With Quicken Loans. Prequalifying for the mortgage was a breeze.

Ad It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. Ad 90 Of Top Lenders Use FICO Scores. Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You.

Find the Best Home Loan Lender for You. You might need a little buffer just in case your scores do drop as the result of some hard inquiries. They said they had saved much more than they would need for the down payment had very good creditscores of 805 and.

In addition to the loan type and economic conditions a good mortgage rate can also vary based on your credit score and the size of the down payment youre able to make. Published Sep 02 2022. Credit score of 580 or higher depending on loan type.

The latest rate on a 51 ARM is 2183. Protect Yourself From a Rise in Rates. This is yet another reason to strive for the best credit score possible.

Top Home Loan Rates. Since its introduction over 25 years ago FICO Scores have become a global standard for measuring credit risk in the banking. Ad Get mortgage rates in minutes.

Make lenders compete and choose your preferred rate. Monitor Your Experian Credit Report Get Alerts. Your credit score determines.

Enter a 200000 principal on a 30-year fixed-rate loan. Your mortgage lender can give you exact terms after reviewing your complete financial details and down payment. The average rate was 278 last week.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Compare Best Mortgage Lenders 2022. Ad Were Americas 1 Online Lender.

Lender Mortgage Rates Have Been At Historic Lows. Moneys daily mortgage rates reflect what a. 740 or higher for strongest rates.

While applying with a credit score less than 600 is possible less than 2 of FHA. Get Your Score Powerful Tools. MyFICO is the consumer division of FICO.

The latest rate on a 71 ARM is 322. Borrowers with a 51 ARM of 100000 with todays interest rate of 279. Borrower A has a 720 FICO credit score and was quoted a rate of 425.

Todays Mortgage Rates Trends - September 1 2022. Ad Were Americas 1 Online Lender. Lock Your Rate Now With Quicken Loans.

Apply Online Get Pre-Approved Today. See Score Factors That Show Whats Positively Or Negatively Impacting Your Credit Score. Mortgage rates for credit score 700 on Lender411 for 30-year fixed-rate mortgages are at 299.

The palms on scottsdale statitician statitician. For example if your middle score is 650 and your wife is a 680 the 650 credit score will be used. Nows the Time to Get Powerful Score Planning Report Protection.

Sales Boomerang Q2 2022 Mortgage Market Opportunities Report Send2press Newswire

Chase Sapphire Preferred Card Credit Score Needed 3 Approval Factors Cardrates Com

Clarke Coole Principal Charter Mellon Linkedin

American Savings Statistics Couponfollow

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

Why Are Mortgage Rates Falling After The Fed Raised Interest Rates

Financial Case Study Am Fm Radio Is The Ideal Medium To Reach In Market High Investable Asset Individuals Westwood One

Blue Business Charts Graphs Reports And Paperwork For Financial And Business Aff Charts Graphs Blue Business F Graphing Chart Charts And Graphs

Ex 99 2

The Week On Wall Street The Search For A Bottom Nysearca Spy Seeking Alpha

Checking Credit Scores Is Easy With These 8 Tools Geekflare

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

Ex 99 2

Checking Credit Scores Is Easy With These 8 Tools Geekflare

Checking Credit Scores Is Easy With These 8 Tools Geekflare

Big Drop In Home Sales Surging Mortgage Rates Tight Supply The New Dynamics Shaping Up Wolf Street

2